The Beginner’s Course

An Introduction to Infinite Banking

A LivingWealth Course

The only tried and true way to succeed financially is through education.

Without a true understanding of the inner workings of the financial world, it is practically impossible to get ahead as the wealthy do. And most effective learning involves a trusted guide with decades of experience.

Our mission is to aggressively help individuals and business owners build a brighter financial future so they can feel (and be) more secure. We believe utilizing Infinite Banking is the best way to engineer that brighter financial future.

This is why we created Lifestyle Banking after over fifty years in the financial industry.

We designed the Lifestyle Banking Beginner’s Course to teach people how to create and profit from banking in a way many have never considered possible! This process is known as the Infinite Banking Concept (IBC) or Infinite Banking for short.

In fact, the tool used to build your “banking” system is the same tool that the largest banks in the world use: Permanent Life Insurance. And it’s not just for banks. The Waltons of Walmart and countless other blue-chip families and companies use it.

In the Beginner’s Course, we discuss the philosophy and principles behind Infinite Banking and offer real-life examples to demonstrate how it works. The case studies show you how to apply IBC to your life with minimal effort and without confusion.

Upon completing this course, you will have all the information you need to know if Infinite Banking is right for you confidently!

Many have heard about this tool, but only some have examined how to use Permanent Life Insurance just like the banks and mega-wealthy families do to create lasting wealth for themselves.

Few, if any others, share the insights openly. As a result, people often call us crazy for giving away our course for free, while others charge large sums for less comprehensive ones. However, we believe in sharing this information to assist as many people as possible.

If you’re searching endlessly for information on this topic, this course will save you loads of time and effort.

We have used this ourselves for over 30 years and have helped thousands of clients based on this.

Studied Infinite Banking before?

Even if you’ve studied Infinite Banking before, we encourage you to take the course. We’re often told by people who are already involved in IBC that they learned a ton from this.

Free Infinite Banking Training Videos

That’s right – free. Don’t let the price tag fool you. Our Beginner’s Course is packed with the core knowledge you need to start using the Infinite Banking methods in your day to day finance.

What's Included In The Beginner's Course

Below is a short summary of each full feature length video that is offered in this course. Enrollment is free, so what are you waiting for?

Welcome to the Beginner’s Course

Lifestyle Banking is all about learning how to utilize Permanent Life Insurance in the most efficient ways possible. This course consists of 10 lessons that are designed to give you everything you need to know about the potential of this process, as well as presenting ideas for implementation.

Episode 1: You Finance Everything That You Buy

Most people have a desire to pay cash for as many things as possible, but then never stop to take a look at the financial impact of paying cash. When you pay cash, you lose all the interest you could have earned on that money! What if there was a better way to purchase things that actually made you a profit? In this lesson, you will learn how powerful it is to always have your money working for you.

Episode 2: How To Break Free From The Banks And Create Your Own Banking Enterprise

Banks make incredible profits by controlling the banking function in our lives. Whether you borrow from them or deposit money with them, they are using YOUR money to build wealth for THE BANK. Your goal should be to become your own banker, and to accomplish this, you need to develop a system where you can recapture the interest you are paying the banks and also the profits they are making on all your deposits.

Episode 3: Why Participating Whole Life Insurance is the Best Tool to Use to Build Your Banking Enterprise

Of all the tools and products available in the financial world, why is Participating Whole Life Insurance the most efficient tool to use to become your own banker? Learn once and for all why Whole Life is the perfect match to establish your “banking” system!

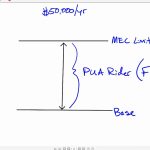

Episode 4: How to Design Your Policy to Maximize Efficiency, Part 1

This lesson describes how policies can be designed on a spectrum, either maximizing the Cash Value or maximizing the Death Benefit. When opening a Participating Whole Life Insurance policy with the goal of becoming your own banker, the focus should not be on the death benefit of the policy, but on how to get the most cash value into the policy that we can use today.

Episode 5: How to Design Your Policy to Maximize Efficiency, Part 2

This lesson dives into exactly how a policy would be designed to maximize the cash value and answers common questions about policy design and premium contributions.

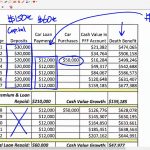

Episode 6: Case Study

Building a Policy to Finance Your Cars- If you were the banker, would it be possible to personally finance all of your cars and make a profit? Of course! And that’s exactly what is revealed in this lesson as we review a case study of using a policy to finance cars for the rest of your life, producing $250,000 in profit. It will be evident how much money banks are currently making from your deposits and loan repayments, and how you can transfer that lost wealth back into your own hands. Always keep in mind, if this process works for financing cars, do you think it will work financing other things in life like vacations, education, weddings, etc.?

Episode 7: How to Use Your Policy to Fund Your Investments, Part 1

Many people mistakenly see a Participating Whole Life Policy as an investment instead of a banking enterprise. They become focused on the “rate of return” of the policy compared to other investment alternatives. In reality, the policy is simply the best banking tool that should be used to FUND your investments. In this lesson, we show you how you can utilize your policies to fund other investments and improve the after-tax returns of every investment you make.

Episode 8: How to Use Your Policy to Fund Your Investments, Part 2

In this lesson Nate reviews a case study describing how a client created $1,000,000 of additional profit on his real estate investments by using his banking enterprise (policies) to fund the investments.

Episode 9: How to Use Your Banking System to Maximize Your Retirement, part 1

Conventional retirement planning is setting many Americans up for failure. The goal of most financial plans is to help you generate the largest nest egg, where the true goal should be to generate the highest amount of passive income to live on. In this lesson, you will learn why the policy is one of the best places to draw the highest amount of passive income during your golden years, and why the conventional retirement advice is built on faulty premises.

Episode 10: How to Use Your Banking System to Maximize Your Retirement, Part 2

In this lesson Nate reviews a case study illustrating how a policy can be used to generate tax-free passive income that can remove the fear of running out of money in retirement.

Beginner’s Course Conclusion

Learn more about how Living Wealth can help you take control and help you put your money to work for you. Fill out the “Schedule A Consult” form below to get in touch with us to learn more and start right away!

Learn From Industry Leaders

Livingwealth is the leading provider of Infinite Banking training in the industry.

Learn at Your Own Pace

If you want to revisit specific lessons, you can do it at any time. Leave and come back at your own pace to ensure your maximum learning.

Professional Support

Ask questions about anything we cover and we'll be more than happy to help!